How To Measure Your Virtual CFO ROI

We asked some entrepreneurs how they determined if their virtual CFO was worth it. They told us it came down to whether they helped them make better decisions and improved financial peformance.

They struggled to quantify their virtual CFOs value to them. So we developed a tool to help determine ROI and wrote this blog post to interpret it.

Here's what you'll find:

- How to determine your virtual CFO investment

- A way to calculate the time and cost savings to your company

- A method to evaluate the value added to you

- The final ROI calculation

How to Determe Your Virtual CFO Investment

This is the easiest part of the calculation - how much did you spend on your virtual CFO? You can get this info from your virtual CFO or from your profit and loss statement.

You'll need to choose a period of time to measure. Most people use one year.

Calculate Time and Cost Savings

Calculating time and cost saved requires some assumptions on your part.

Time Savings

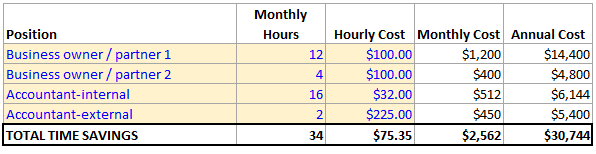

To quantify time savings we need to look at the number of hours saved multiplied by an hourly rate. The information we need are the positions that are impacted, the hourly rate for each and an estimate of the number of hours saved for each one.

Identify each position that has been impacted by hiring a virtual CFO. One of them will be your own. Do a survey of employees and find out how many hours each month were saved by bringing on a virtual CFO. Write this out for each position.

RELATED: The Ultimate Guide to Working With a Virtual CFO [ARTICLE]

Next determine a rate for each position. For full time employees, multiply their hourly rate by 1.15. This will account for payroll taxes and any benefits.

Now, put them into a spreadsheet. It will look something like this:

Cost Savings

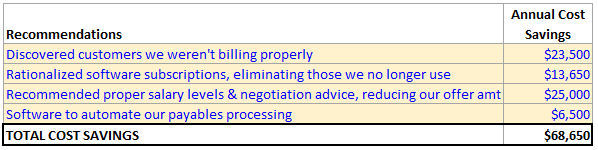

For cost savings you're looking at specific recommendations the virtual CFO made and will quantify each. If you are struggling to recall any, ask your virtual CFO.

Some cost savings areas we typically see include:

- Correcting billing errors to customers

- Terminating unused software subscriptions

- Software to automate various functions

- Process improvements

- Overhead expense reductions

Write down the cost savings for the year and put them in a spreadsheet. It will look something like this:

Evaluate Virtual CFO Value Added

There is a value to your organization of having a virtual CFO that is hard to quantify. Business owners generally rely on two observations:

- Did the financial performance of my company improve?

- Is my business life better now that my virtual CFO is in it?

|

PRO TIP Work through the ROI calculation with your virtual CFO. It provides a great opportunity to assess how the relationship is working for both of you |

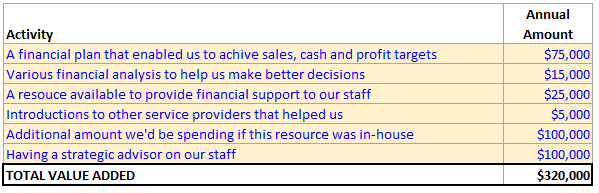

While the amounts will be different for each company, the activities are generally pretty consistent. Here are some areas to evaluate:

- A financial plan was put in place that enabled you to achieve sales, profit and cash flow targets

- Having a strategic advisor on staff lead to much better decisions based upon sound economic principles

- Confidence that your financial operation is not holding back growth

- A resource was available to direct financial staff

- How much extra would we be spending if this resource was full-time

- Introductions to service providers resulting in immediate value

Write them down and put some numbers next to each. You'll come up with a table that looks something like this:

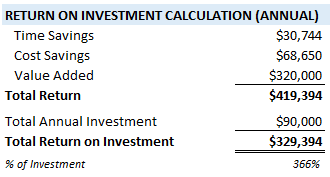

Calculate the Return on Investment

At this point, we've got all our variables in place. You can download our spreadsheet to make things a bit easier for you.

The ROI calculation is straightforward:

ROI = Total Return $ ÷ Total $ Invested x 100

We multiply by 100 to convert the calculation to a percent.

Let's assume our virtual CFO investment is $7,500 per month - $90,000 per year. Using the information from above our virtual CFOs ROI is $329,394 or 366%:

Not a bad return on investment! If you make this calculation each year you can determine your virtual CFO ROI over time and make sure its meeting your needs.

|

LEARN MORE The Ultimate Guide to Working With a Virtual CFO Everything you need to know about sourcing candidates, what they cost, how they work and much more! |